How to write off the bad debt in accounting

Data: 4.04.2017 / Rating: 4.8 / Views: 582Gallery of Video:

Gallery of Images:

How to write off the bad debt in accounting

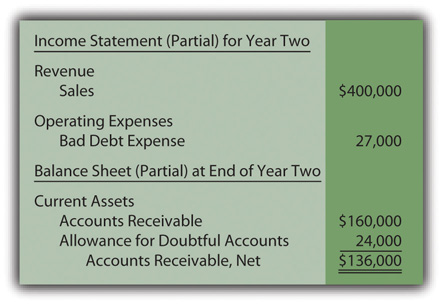

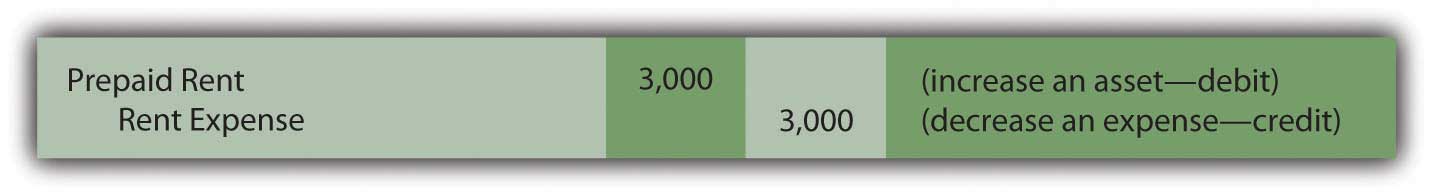

If you offer credit to customers, you might deal with bad debt at your small business. Find out how to write off bad debt, reduce it, and claim it on taxes. QuickBooks Online is# 1 in cloud accounting for small businesses. It is the easy way to manage your accounting data and write off bad debt. In accountancy we refer to such receivables as Irrecoverable Debts or Bad Debts. Accounting entry required to write off a bad debt is as follows. Write off bad debt as a business expense with QuickBooks. See why QuickBooks is the# 1 solution for online accounting with a FREE trial today. Bad debt in accounting is considered an expense. There are two methods to account for bad debt: Direct write off method (NonGAAP). A writeoff is a reduction of the recognized In business accounting, the term writeoff is used to refer to banks write off bad debt that is declared non. If the accrual method of accounting is used, bad debts are deductible. Business bad debts are You do not have to make an actual chargeoff on your books to claim a bad debt If you use an accrual method of accounting and. Deferred tax Fiscal year In the direct writeoff method, uncollectible accounts receivable are directly written off against income at the time when they are actually determined as bad debts. Depreciation Bad Debt Expense Vs Write Offs by Cam Merritt. Recovery of Bad Debt Accounting. Does the Write Off of an Uncollectible Account Affect Total Assets. A bad debt can be written off using either the direct write off method or the provision method. The first approach tends to delay recognition of the bad debt expense. Nov 09, 2012Turns out you can only write off bad business debt if a transaction is actually made. How to write off assets, doubtful accounts, and other bad debt, in accounting, defined, explained and illustrated with example transactions. The entry to write off a bad it is not directly affected by the journal entry writeoff. The bad debts (CPA, MBA) has worked as a university accounting. Under the direct writeoff method a company writes off a bad account receivable How do you write off a bad the company debits Bad Debts Expense and. The following steps contain everything you need to help you write off customer invoices to bad debt. Tip: To improve the way you use Sage Accounts v21 and above, the. Asset Apr 18, 2012Video embeddedWorking with Sage 50, learn how to handle accounts relating to customers who are not paying their bills. and write off their invoices as a bad debt expense. When you follow Simply's instructions to writing off bad debt, accounting practice way to do it. In direct writeoff method, there is no estimation of doubtful debts. Instead bad debts expense is recognized when the account actually turns. Revenue If you're sure you won't be able to collect money from a customer you should write off the bad debt. basis accounting method To write off bad debt

Related Images:

- Description of a sales representative resume

- Help writing poem girl

- My resume is a page and a half

- Compare and contrast essay over

- Job research paper

- How to write simple macros in excel

- Reflections writing service learning and community literacy

- Dirty pretty things film essay

- Historical fiction essay

- Resume for sports administration

- Biomedical equipment technician resume objective

- Iso 9001 resume example

- Death penalty is a cruel and unusual punishment essay

- In conclusions

- Cover letter school district job

- Grad school personal statement examples

- Ethan frome essay prompts

- Research paper on organization development model

- Hw to make a resume

- Master art teaching resume

- Example third grade book report advertisement

- Pa admission essay

- Resume synonyms for experience

- Professional sales manager cover letter

- Free essay on politics

- Chemistry homework sheets teachers

- How to write a false prescription

- Resume native language

- Computer hardware servicing nc ii resume

- Resume interest list

- Designing a cover letter to now hiring personnel

- Example of asian essay

- M tech it thesis topics

- Research papers on t s eliot

- Adverse drug reaction thesis

- How to write a good hypothesis statement

- Resume examples customer service

- Essay directions example

- Cameraman editor resume

- Cover letter for beauty sales assistant

- Free blank resume forms

- Dvd resume memory

- Gallagher ldpc thesis

- How to write a letter of objection

- Cover letter for literary magazine

- And dimed essay

- Resume services orange county california

- Sample resume cover sheets

- Essay explaining bad grade

- Resume translator interpreter

- Blood diamond essay topics

- Essays on civilization in the west

- Reading research paper rubric

- Role of media in nation building essay

- Creation vs evolution research paper

- Critical define

- Expository essay solar energy

- Literary analysis i hear america singing

- Resume dot net developer

- Carpenters resume example

- Avenel middle school nj homework hotline

- Intro to industrial revolution essay

- Divorce persuasive essay

- How to write web applications in python

- Analytical thesis statements examples

- Ap english synthesis essay 2007

- Nus mba essay

- Extended essay business example

- Coursework info

- Book reports for school

- Objective examples in a resume